Chips don't come from a single company—they emerge from a global symphony of specialized players, each mastering a critical step in the semiconductor value chain. Understanding this complex ecosystem is essential for anyone working in technology, as disruption in any single link can ripple across the entire tech landscape, from smartphones to AI servers.

The 8-Layer Semiconductor Value Chain

The semiconductor industry operates through eight distinct layers, each requiring specialized expertise, massive capital investments, and years of development. Understanding these layers reveals why the chip industry is simultaneously the most complex and most critical technology ecosystem on Earth.

1. Design (IP) — The Blueprint Stage

These companies design instruction sets and microarchitectures used by almost every modern SoC. They create the fundamental building blocks that enable chip designers to build complex processors without starting from scratch.

Key Players

- • ARM: CPU cores (95% of mobile)

- • Imagination: GPU architectures

- • Synopsys: Interface IP

- • Cadence: Memory controllers

Value Creation

- • Reusable design components

- • Proven architectures

- • Reduced development time

- • Licensing revenue model

2. EDA Tools — The Invisible Engines

Electronic Design Automation tools are the invisible engines of chip creation and testing. These sophisticated software platforms enable engineers to simulate, test, and tape-out billion-transistor chips with precision and reliability.

3. Fabless Designers — Innovation Focused

These companies design chips but outsource manufacturing, betting everything on innovation and execution. They focus purely on creating the best possible chip designs while leveraging foundry expertise for production.

4. Foundries — The Ultra-Precise Builders

Foundries are the ultra-precise factories that turn blueprints into working silicon. They operate some of the most advanced manufacturing facilities on Earth, capable of building structures smaller than viruses with atomic precision.

The Supporting Infrastructure: Enabling the Ecosystem

The semiconductor value chain depends on sophisticated supporting infrastructure that enables the core design and manufacturing activities:

5. Integrated Device Manufacturers (IDMs)

IDMs do it all—design, manufacture, package, and sell. This vertical integration approach provides complete control over the supply chain but requires massive capital investments.

6. Raw Materials — The Foundation

Without ultra-pure silicon wafers and specialized gases, there are no chips. These companies supply the physical foundation that makes semiconductor manufacturing possible.

7. Equipment Vendors — Nanometer Precision

These companies make the ultra-complex machines that build chips—EUV scanners, etchers, and deposition tools that operate at the limits of physics and engineering.

8. Testing & Packaging — Final Mile

Before chips ship, they're packaged, tested, and binned. These firms ensure reliability at nanometer scale and transform bare silicon into market-ready products.

The Interconnected Web: How the Value Chain Works

The semiconductor value chain operates as a highly interconnected system where each layer depends on the others. Understanding these relationships is crucial for appreciating the industry's complexity and fragility.

Value Chain Flow: From Concept to Consumer

How ideas become chips through the global semiconductor ecosystem

Concept & Architecture

System companies (Apple, Dell) define requirements → IP companies (ARM) provide architectures → EDA tools (Synopsys) enable design

Design & Verification

Fabless companies (NVIDIA) create chip designs → EDA tools verify functionality → TestFlow validates post-silicon performance

Manufacturing & Assembly

Materials companies provide substrates → Equipment vendors supply tools → Foundries (TSMC) manufacture → OSATs package and test

Integration & Deployment

System companies integrate chips into final products → End users experience the technology → Feedback drives next-generation requirements

Critical Dependencies: Single Points of Failure

The semiconductor value chain's complexity creates critical dependencies that can impact the entire global technology ecosystem. Understanding these chokepoints is essential for risk management and strategic planning.

Critical Chokepoints

- ASML EUV: 100% monopoly on advanced lithography

- TSMC Advanced Nodes: 90%+ of cutting-edge manufacturing

- ARM Architecture: 95% of mobile processor designs

- Specialty Materials: Limited suppliers for critical chemicals

Resilience Strategies

- Geographic Diversification: Multiple manufacturing locations

- Alternative Technologies: RISC-V, new architectures

- Strategic Partnerships: Cross-layer collaboration

- Government Investment: National semiconductor strategies

"The semiconductor world isn't one company—it's a global supply chain of extreme complexity. Disrupt one link, and the whole world feels it—from smartphones to AI servers."

TestFlow's Position in the Value Chain

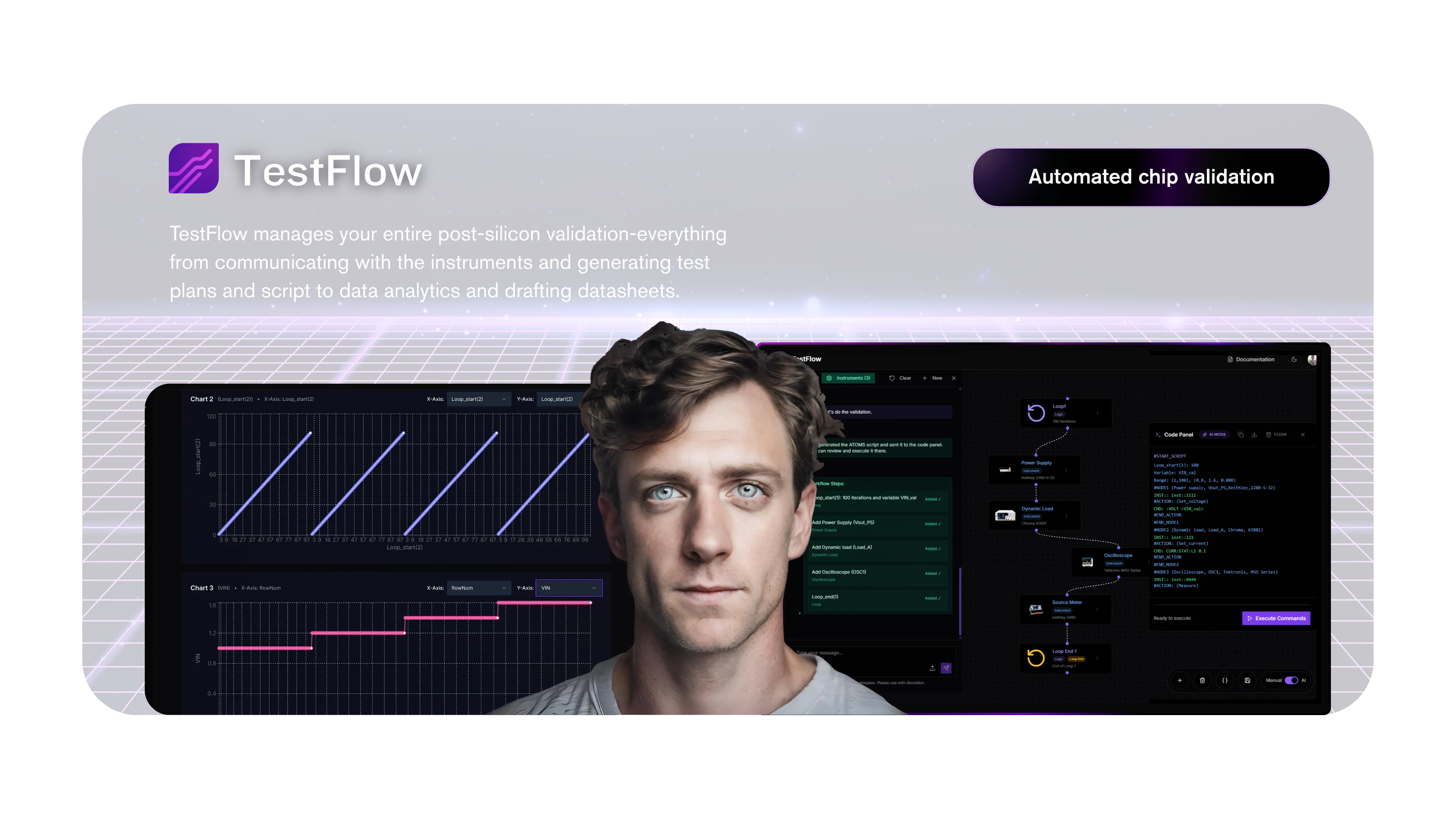

TestFlow occupies a critical position in the semiconductor value chain, bridging the gap between design and manufacturing through advanced post-silicon validation capabilities.

TestFlow: The Missing Link in Semiconductor Validation

AI-powered post-silicon validation platform that accelerates the critical path from silicon to market

TestFlow's Value Chain Integration

EDA Integration

Seamlessly connects with pre-silicon EDA tools, enabling smooth transition from design verification to post-silicon validation.

Foundry Collaboration

Works with foundries and IDMs to validate manufactured silicon, ensuring designs work correctly in real-world conditions.

System Integration

Enables system companies to validate chip performance in their target applications, accelerating product development cycles.

Economic Impact: The Trillion-Dollar Ecosystem

The semiconductor value chain represents one of the largest and most valuable industrial ecosystems in human history, with each layer contributing significant economic value:

| Value Chain Layer | Market Size (2025) | Growth Rate | Key Value Drivers |

|---|---|---|---|

| Chip Design/IP | $6.5B | 12% CAGR | Licensing, reusability |

| EDA Tools | $15.2B | 8% CAGR | Design complexity |

| Semiconductor Sales | $650B | 6% CAGR | AI, automotive, IoT |

| Equipment | $95B | 10% CAGR | Fab investments |

| Materials | $35B | 7% CAGR | Manufacturing volume |

Disruption Ripple Effects: When Links Break

The interconnected nature of the semiconductor value chain means that disruptions in any single layer can have far-reaching consequences across the entire technology ecosystem.

Recent Disruption Examples

COVID-19 Supply Chain Impact (2020-2022)

Factory shutdowns in Asia cascaded through the entire value chain, causing global chip shortages that impacted everything from automobiles to consumer electronics, resulting in over $500B in lost revenue across industries.

Geopolitical Trade Restrictions (2018-Present)

Export controls on EDA tools, equipment, and advanced chips forced companies to redesign supply chains, develop alternative technologies, and invest in domestic capabilities.

Natural Disasters and Regional Disruptions

Earthquakes, power outages, and other regional disruptions in key manufacturing hubs demonstrate the vulnerability of concentrated production.

The Future of the Semiconductor Value Chain

As the semiconductor industry continues to evolve, several trends are reshaping the traditional value chain structure and creating new opportunities and challenges:

Emerging Trends

- • AI-native chip architectures

- • Chiplet and modular design approaches

- • Advanced packaging becoming critical

- • Edge computing driving new requirements

- • Sustainability and energy efficiency focus

- • Quantum computing integration

Value Chain Evolution

- • Increased vertical integration in critical areas

- • New players entering traditional segments

- • Software becoming more important

- • Validation and testing growing in importance

- • Regional ecosystem development

- • Collaboration platforms enabling efficiency

"Chips don't come from one company—they come from a global stack of deeply specialized players. And any disruption in one layer—materials, tools, fabs—can ripple across the entire tech ecosystem."

Conclusion: Mastering the Semiconductor Symphony

The semiconductor industry's value chain represents one of humanity's most complex and sophisticated industrial achievements. From the fundamental physics of silicon crystals to the advanced AI algorithms running on finished chips, every layer requires extraordinary expertise, massive investments, and precise coordination.

Understanding this ecosystem is crucial for anyone working in technology, whether you're designing chips, building systems, or investing in the future. The interdependencies are so complex that success requires not just excellence in your own layer, but understanding and collaboration across the entire value chain.

As the industry continues to evolve toward AI-native architectures, advanced packaging, and new computing paradigms, the companies that thrive will be those that can navigate this complexity while delivering the reliable, high-performance semiconductors that power our digital future.

Navigate the Semiconductor Value Chain with TestFlow

Whether you're working in design, manufacturing, or system integration, TestFlow provides the validation capabilities needed to succeed in the complex semiconductor ecosystem. Our AI-powered platform bridges critical gaps in the value chain, enabling faster, more reliable chip development.