The explosive growth of artificial intelligence rests on a surprisingly concentrated supply chain controlled by just four major companies. From chip design and fabrication to deployment infrastructure, NVIDIA, ASML, TSMC, and AWS have established near-monopolistic positions that shape the entire AI hardware ecosystem.

The artificial intelligence revolution has created unprecedented demand for specialized computing hardware, but the supply chain powering this transformation is remarkably concentrated. Understanding these dependencies is crucial for anyone working in AI, semiconductors, or technology infrastructure.

1. NVIDIA – The Architect of AI Chips (80–95% Market Share)

At the forefront of AI hardware stands NVIDIA, commanding an extraordinary 80% to 95% of the AI chip market. What began as a graphics card company has evolved into the undisputed leader in AI acceleration hardware.

The GPU Revolution

Originally designed for graphics rendering, NVIDIA's GPUs proved perfectly suited for the parallel processing demands of machine learning. With thousands of specialized cores optimized for matrix mathematics, these chips can perform the massive parallel computations required for AI training and inference.

Key Technologies:

- • CUDA parallel computing platform

- • Tensor cores for AI workloads

- • NVLink high-speed interconnects

- • Advanced memory architectures

Market Impact:

- • Powers 95% of AI training workloads

- • Essential for LLM development

- • Drives autonomous vehicle computing

- • Enables real-time AI inference

NVIDIA's dominance extends beyond hardware into software ecosystems. Their CUDA platform has become the de facto standard for GPU programming, creating a powerful moat that makes switching to competitors extremely difficult. The rise of generative AI, from ChatGPT to DALL-E, would look fundamentally different without NVIDIA's specialized silicon.

"The rise of generative AI would look very different without NVIDIA. Their GPUs have become the foundation upon which the entire AI revolution is built."

2. ASML – Advanced Semiconductor Fabrication (100% Market Share)

When it comes to the most advanced semiconductor manufacturing, ASML holds a complete monopoly. The Dutch company is the sole producer of extreme ultraviolet (EUV) lithography machines—the tools required to manufacture cutting-edge chips at 5nm and below.

EUV Lithography: The Ultimate Bottleneck

EUV lithography uses light with a wavelength of just 13.5 nanometers to print incredibly fine circuit patterns. These machines are marvels of engineering—each one takes six months to assemble, costs over $150 million, and requires a supply chain spanning multiple continents.

Extreme Precision

EUV machines can print features smaller than 10 nanometers—equivalent to about 50 silicon atoms wide. This precision enables the dense transistor packing required for AI chips.

Complex Engineering

Each machine contains over 100,000 parts and requires mirrors polished to within 1/10,000th the width of a human hair. The light source creates plasma hotter than the sun's surface.

Strategic Importance

Without ASML's EUV machines, fabs cannot produce the advanced logic chips that power AI applications. This creates a critical chokepoint in the global supply chain.

ASML's monopoly position makes it perhaps the most strategically important company in the semiconductor ecosystem. Every chip giant—from TSMC to Samsung to Intel—depends on ASML's machines to manufacture their most advanced products. The company's limited production capacity (around 60 EUV machines per year) creates a significant bottleneck in global chip manufacturing capacity.

3. TSMC – Fabricating the Future of AI Chips (90% Market Share)

Taiwan Semiconductor Manufacturing Company (TSMC) manufactures approximately 90% of the world's most advanced chips, serving customers including NVIDIA, Apple, AMD, and virtually every major chip designer.

Manufacturing Excellence

TSMC's unmatched expertise in leading-edge nodes (3nm, 5nm) and advanced packaging technologies like CoWoS and InFO makes it the foundry where the AI era is physically built. Their ability to scale, achieve high yields, and continuously innovate in process technology is why AI hardware continues to improve year over year.

Advanced Packaging

Beyond traditional chip manufacturing, TSMC leads in advanced packaging solutions that enable the complex multi-chip modules required for high-performance AI systems. Technologies like CoWoS (Chip-on-Wafer-on-Substrate) allow multiple chips to work together as a single, powerful computing unit.

| Technology Node | Key Applications | TSMC Market Share |

|---|---|---|

| 3nm | Next-gen AI chips, mobile processors | ~100% |

| 5nm | NVIDIA AI GPUs, Apple Silicon, AMD processors | ~92% |

| 7nm | High-performance computing, automotive AI | ~70% |

TSMC's position is particularly crucial because chip design and manufacturing have become increasingly specialized. Most chip companies now focus on design while outsourcing manufacturing to foundries like TSMC. This fabless model has created enormous dependencies on TSMC's manufacturing capabilities and capacity.

4. Amazon Web Services (AWS) – Powering AI Compute (32% Market Share)

AWS delivers the computational infrastructure behind AI training and deployment, commanding 32% of the global cloud market and providing the platform where most AI innovation actually happens.

The Cloud AI Infrastructure

Beyond hosting, AWS provides the complete infrastructure stack for AI development:

Core Services:

- • EC2 instances with NVIDIA GPUs

- • S3 for massive dataset storage

- • SageMaker for ML development

- • Bedrock for foundation models

Custom Silicon:

- • Trainium for AI training

- • Inferentia for AI inference

- • Graviton for general compute

- • Nitro for virtualization

AWS's strategy extends beyond providing infrastructure to designing custom silicon optimized for AI workloads. Their Trainium and Inferentia chips offer alternatives to NVIDIA's GPUs for specific AI tasks, potentially reducing some of the industry's dependence on NVIDIA while still maintaining AWS's central role in AI infrastructure.

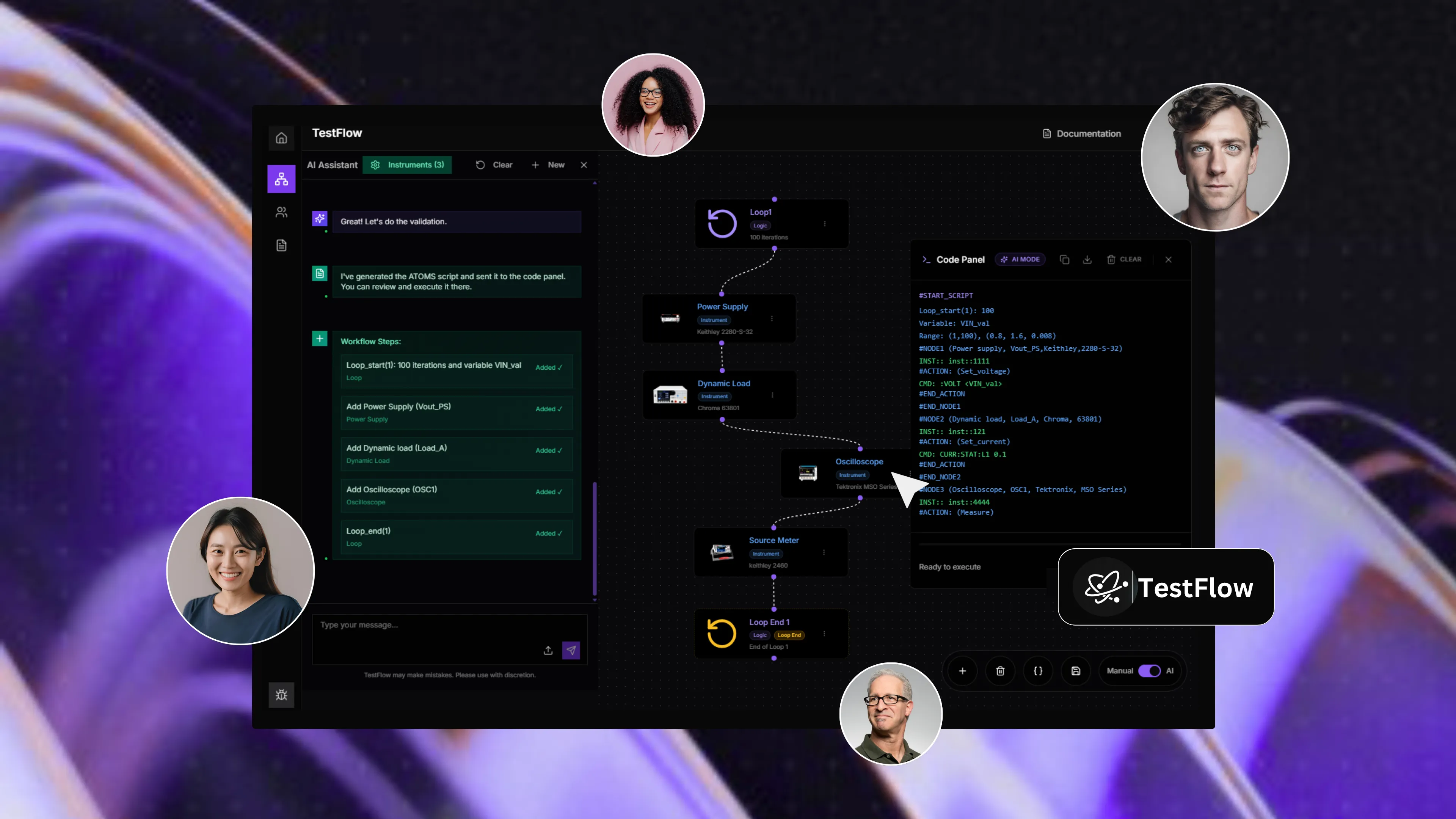

TestFlow: Supporting the AI Chip Ecosystem

As AI chips grow more complex, TestFlow helps validation teams automate testing, analyze data, and collaborate faster to meet industry demands

The Implications of Supply Chain Concentration

This concentration of power in just four companies creates both opportunities and risks for the AI ecosystem:

Advantages

- Rapid Innovation: Concentrated expertise drives faster technological advancement

- Ecosystem Integration: Tightly integrated supply chains enable complex AI systems

- Scale Economics: Large volumes drive down costs and improve performance

Risks

- Single Points of Failure: Disruption to any company could halt AI progress

- Geopolitical Vulnerability: Trade restrictions could fragment the ecosystem

- Innovation Bottlenecks: Limited competition may slow advancement in some areas

The Role of Validation in the AI Supply Chain

As AI chips become increasingly complex and critical to global infrastructure, the validation and testing phase becomes more crucial than ever. Each of these four companies depends on sophisticated validation processes:

TestFlow's Role in Supporting the AI Ecosystem

We're building TestFlow to support the teams working in these critical stages—helping them automate chip validation, analyze chip data, and collaborate faster to keep pace with the industry's demands.

For Chip Designers:

- • Automated test generation for AI accelerators

- • Advanced analytics for performance optimization

- • Collaborative validation workflows

For Manufacturers:

- • Yield optimization through intelligent testing

- • Real-time quality monitoring

- • Predictive failure analysis

"AI's explosive growth rests on a supply chain controlled by just a few players. From fabrication and lithography to deployment and training—NVIDIA, ASML, TSMC, and AWS are the pillars of the AI hardware ecosystem."

Looking Ahead: Diversification Efforts

Recognizing the risks of this concentration, both governments and companies are investing in supply chain diversification:

- Geographic Expansion: TSMC is building fabs in the US and Japan, while Intel and Samsung are expanding foundry capabilities

- Alternative Architectures: Companies like Google, Intel, and AMD are developing AI chips to challenge NVIDIA's dominance

- Open Standards: Initiatives like RISC-V and open-source AI frameworks aim to reduce dependencies

- Government Investment: The CHIPS Act and similar programs worldwide are funding domestic semiconductor capabilities

Conclusion: The Foundation of AI's Future

The AI revolution's remarkable progress has been enabled by the concentrated expertise and massive investments of four key companies. NVIDIA's AI chips, ASML's lithography machines, TSMC's manufacturing capabilities, and AWS's cloud infrastructure form the backbone of the AI ecosystem.

While this concentration has accelerated AI development, it also creates strategic vulnerabilities that the industry is beginning to address. As AI becomes increasingly central to global economic and military competitiveness, ensuring the resilience and accessibility of this supply chain will be crucial.

For companies working in this ecosystem, understanding these dependencies—and the validation challenges they create—is essential for building robust AI systems that can operate reliably at scale.

Support Your AI Chip Validation

As AI chips grow more complex, TestFlow helps validation teams automate testing, accelerate time-to-market, and ensure reliability in this critical supply chain. Join the companies building the future of AI hardware.